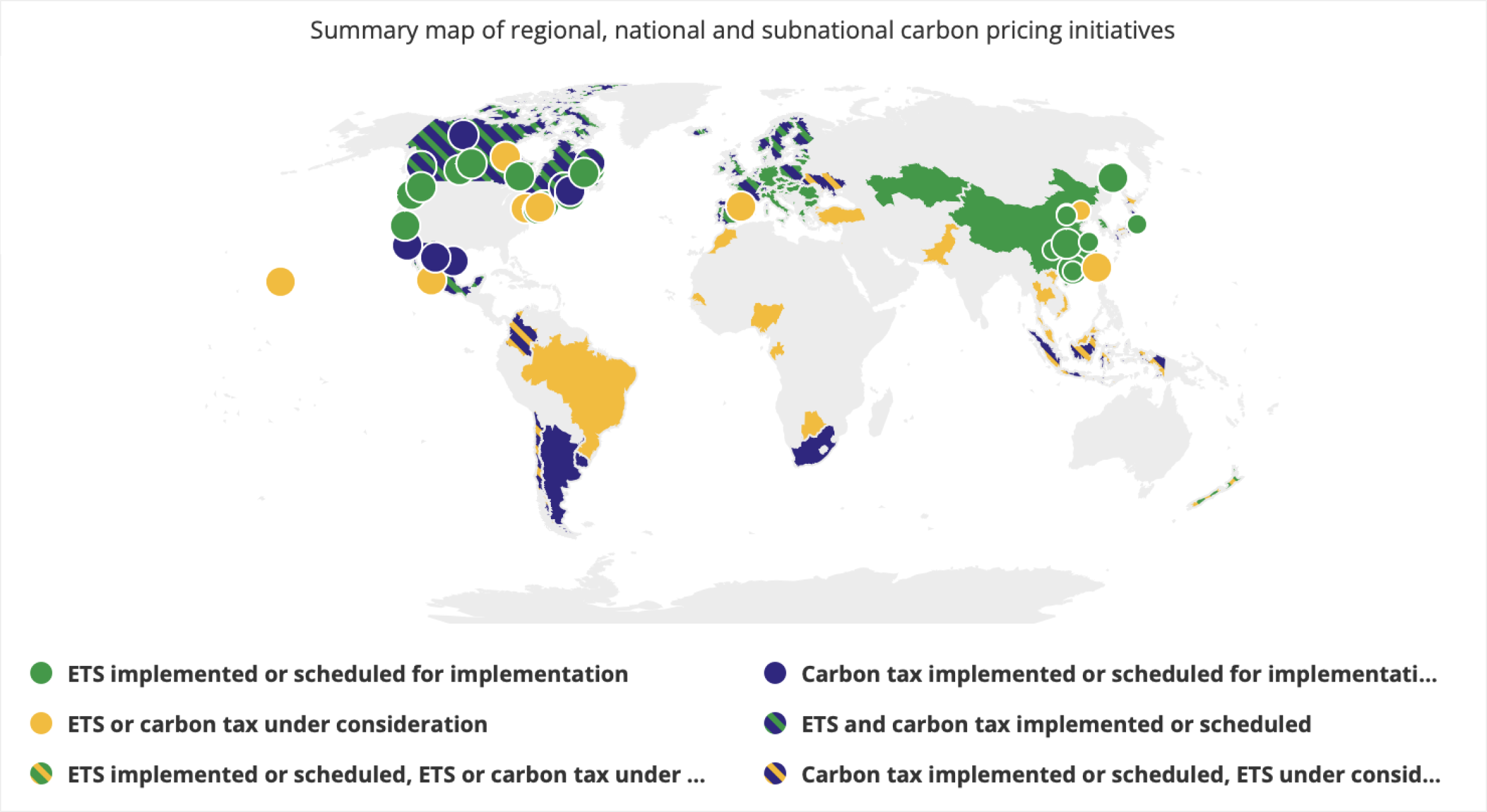

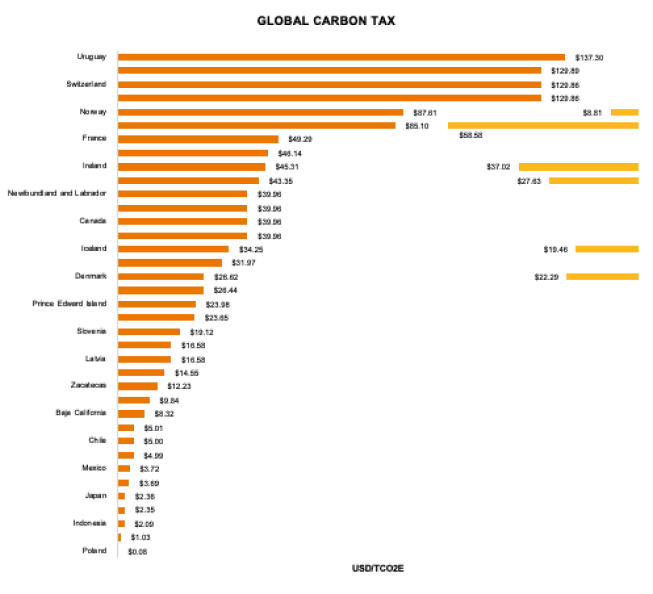

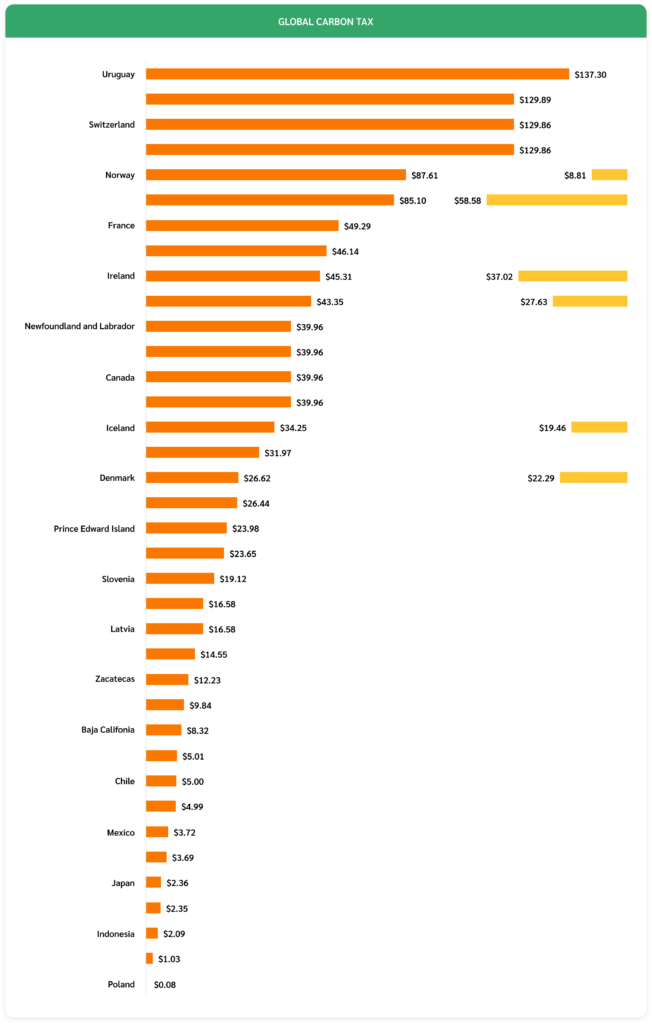

Carbon Tax

A carbon tax is a fee imposed on the burning of carbon-based fuels (coal, oil, gas). More to the point: a carbon tax is the core policy for reducing and eventually eliminating the use of fossil fuels whose combustion is destabilizing and destroying our climate.

A carbon tax is a way — the only way, really — to have users of carbon fuels pay for the climate damage caused by releasing carbon dioxide into the atmosphere. If set high enough, it becomes a powerful monetary disincentive that motivates switches to clean energy across the economy, simply by making it more economically rewarding to move to non-carbon fuels and energy efficiency.

Iron

Chemical Fertilizer

Electricity

Aluminum

Cement

Iron

Aluminum

Chemical Fertilizer

Cement

Electricity